New research from Schroders suggests investors should dig down into sectors and individual stocks to find well-priced sustainable opportunities.

Companies ranked strongly for sustainability credentials trade at a higher multiple than those that perform less well – but many opportunities remain for investors, according to new research.

An analysis of valuation metrics for companies on the MSCI ACWI index, conducted by Schroders, found that for almost every major industry sector the top 25 per cent of stocks by environmental, social and governance score were valued significantly higher than the bottom 25 per cent. ESG scores were assessed by FTSE-listed asset manager Schroders’ proprietary SustainEx model.

However, Schroders head of strategic research Duncan Lamont said this did not mean there were no attractive investment opportunities for sustainability-focused investors.

“These industries are portrayed as the bad guys when it comes to environmental impact,” Lamont said. “They are under the spotlight more than most. So it goes to figure that the market will have differentiated more between them, marking up those who are better placed to navigate the coming decades, and [marking] down those who risk being in the firing line.”

Measuring across quartiles did not show the whole picture, Lamont added. While the data indicated that “the market gets many of the big-picture calls approximately right”, there were still many areas in which ESG risks were not adequately priced in.

Opportunities in the detail

Lamont said this still gave companies an incentive to improve their ESG credentials, while investors could still be rewarded for engaging positively with companies to encourage these improvements. This was especially evident when drilling down into each of the three pillars of ESG.

Diana Rose, head of ESG research at sustainability data specialist Insig AI, said focusing in on specific elements of ESG was “key to isolating attributes that may still be undervalued by the market”. While climate change had been dominating most ESG investment discussions over the past few years, she said, there were other “key environmental issues being overlooked at the moment”.

“The savvy investor will be anticipating emerging regulation such as the Taskforce on Nature-related Financial Disclosures,” Rose said. “While the herd is following the carbon price, some digging will reveal there are some environmental areas, such as water and waste, that present tangible and imminent risks and opportunities – particularly for certain industries.”

However, for social issues, investors needed to do more digging to unearth risks as disclosures and data were patchier, making it harder to identify risks and opportunities, she said.

“There are more frameworks getting traction to define what ‘good’ looks like in this space, but still a greater demand on the investor to unearth evidence that companies are leading or lagging against their peer group,” she added. “This comes down to primary research and due diligence – reading between the lines of glossy reports to spot the gaps that might present material risks alongside impressive stats on social investment.”

Better data, better valuations?

Schroders’ research echoes many academic papers of recent years, which have reported links between companies’ ESG credentials and improved investment performance. A paper published in November 2019 found that institutional investors overall did not believe that equity valuations fully reflected climate-related risks.

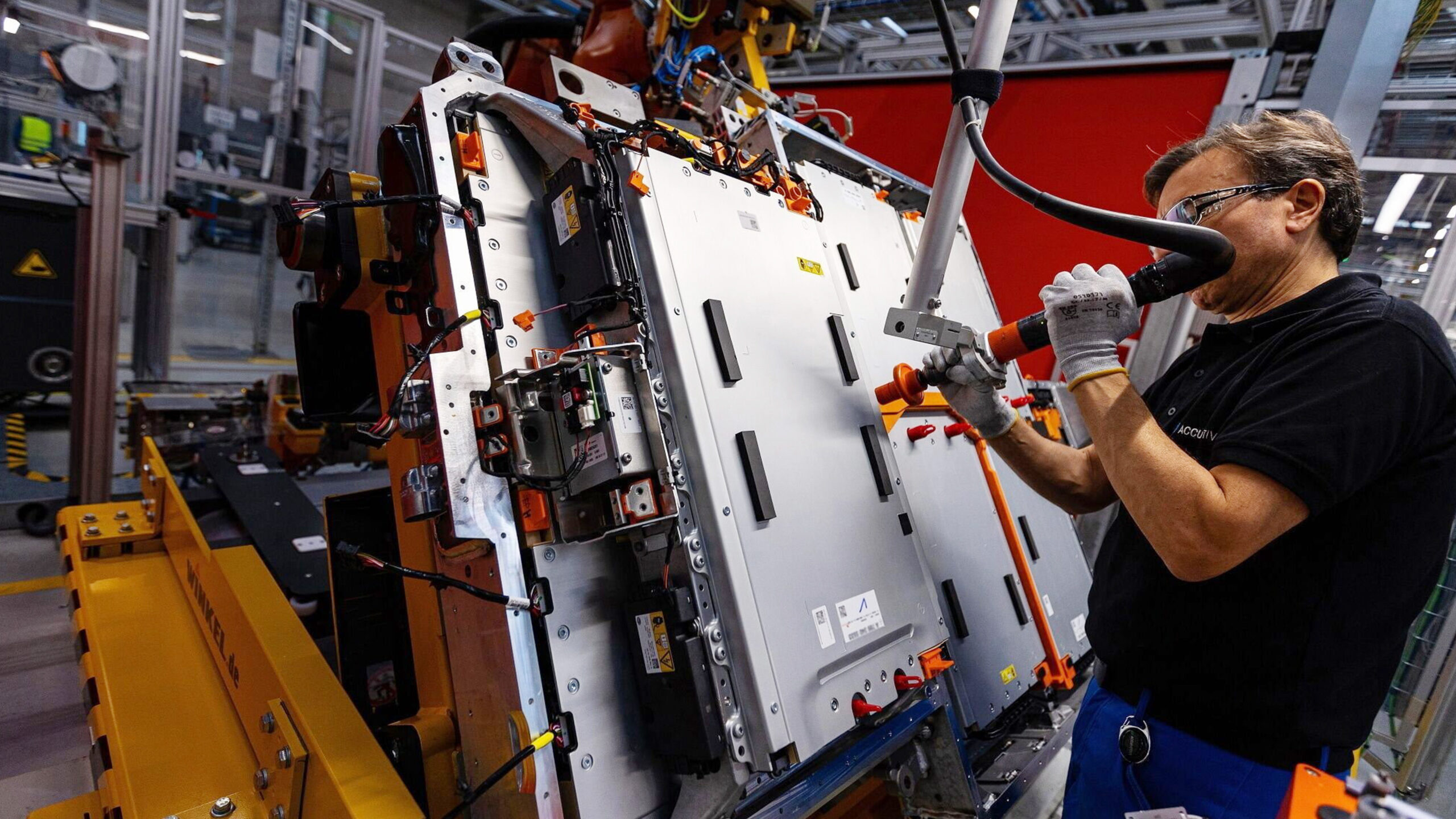

The authors – Philipp Krueger of the University of Geneva, Zacharias Sautner of the Frankfurt School of Finance & Management, and Laura Starks of the University of Texas – said investors believed sectors such as oil and gas, car manufacturing, and utilities tended to be overvalued considering the climate-related risks they faced.

They said the results indicated that the investment industry was “still at [the] early stages of incorporating these risks into their investment processes”, with larger asset owners tending to be “better prepared for the transition to a low-carbon economy”.

Chris Bennett, managing director of sustainability consultancy Evora Global, said good data was the cornerstone for identifying sustainable companies.

“Increasingly, institutions are putting pressure on investment managers to supply ESG data and have a stack of questions about sustainability,” he said. However, he said there hadn’t been a significant impact on valuations – particularly in areas such as real estate, where he said “climate risk is not being priced in”.

Disclosure laws

Several jurisdictions are implementing reporting and disclosure rules to improve the amount of information available to investors to assess climate and sustainability-related risks.

In the UK, the government implemented rules to require reporting in line with the recommendations of the Task Force on Climate-related Financial Disclosures at the start of this year. The rules apply to all reports for financial years beginning on or after 6 April 2022, and Bennett said some companies might be “viewed in a different light” after this information is published.

“I am pleased the recommendations of TCFD have now been enshrined into law,” he said. “It’s the sort of approach we need where companies must provide markets with proper information with regards to their climate risk.”

The EU requires listed and financial companies to report non-financial information, and is working on creating its own sustainability disclosure standards, while the US Securities and Exchange Commission is currently considering climate-related reporting requirements for listed companies.

Similar Articles

In Charts: Canada, Japan, South Korea ‘blocking clean energy transition’ with fossil fuel finance

In Charts: Build climate resilience into infrastructure financing, says OECD